How do Trump’s Tariffs impact the Climate Tech Sector?

Challenges & Opportunities for climate tech in a new tariffed market

Welcome to The Green Techpreneur — where nature-loving climate founders and investors connect, collaborate, accelerate and celebrate impact!

We’re your high-value connector platform: we offer an investor/startup Climate Marketplace to help you raise funds and founder-led stories packed with innovation and insight. Join our growing network of 5,200+ climate tech entrepreneurs, investors, and sustainability champions shaping the future.

🔥 For Investors:

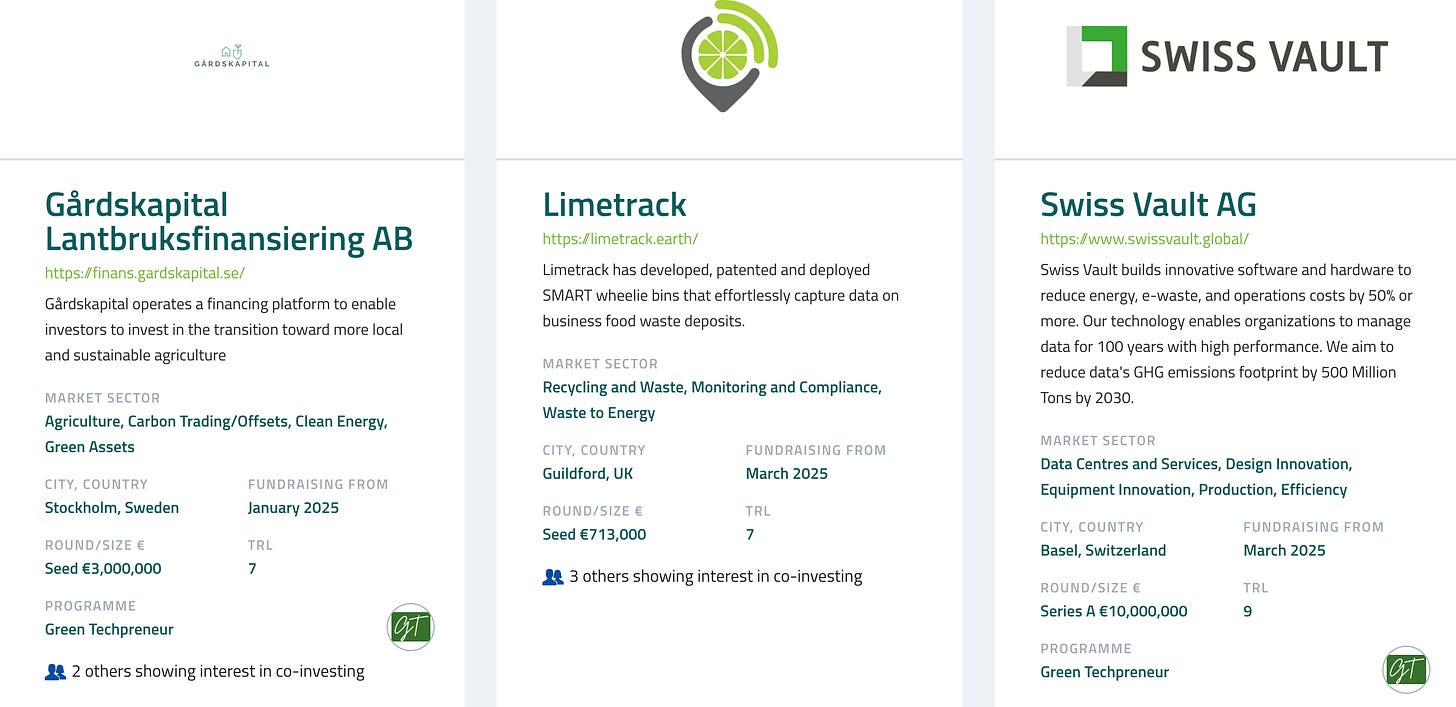

Explore our latest climate investment opportunities on the Climate Marketplace. Register as an investor to unlock pitch decks, startup details, and direct contact — just hit ‘Show Interest’ to connect with startups. No fees, no cuts — 100% of the deal is yours.

🌱 For Founders:

We’re excited to launch something new — and free — just for you!Join our Weekly Pitch Clinic — every Friday at 5:00 pm GMT.

It’s your chance to practice your pitch, get instant expert feedback, and refine your story in a supportive space designed to help your fundraising.✅ Sign up below to save your spot — and come ready to pitch!

"At the pitch clinic, I was given prompt feedback with valuable suggestions that led me to focus more on the entrepreneurial approach." — Sarper Yasar, Founder of Water Hooper (Turkey)

See you there — let’s build the future, together.

How do Trump’s tariffs impact climate tech?

The world trading system blew up overnight with the arrival of Trump’s ‘Liberation Day’ on Wednesday 2nd April, bringing with it a strong likelihood of a stagnating global economy.

Effective April 5th, a baseline 10% tariff will apply to all imports, with significantly higher rates targeting key trading partners—China (54%), Vietnam (46%), Thailand (36%), Japan (24%), and the EU (20%) among others.

This is a massive moment in geopolitics & economics. In the immediate aftermath, global stock markets have plunged, and some trading partners have implemented or threatened reciprocal tariffs. The tariffs introduced by President Trump amount to the largest such levy to face American consumers in almost a century.

So what does this mean for climate tech founders, investors, and eco-warriors, and how should we respond?

Let’s take a look at the likely impact on the climate tech sector.

Key Impacts on Global Climate Tech Startups

The climate tech industry relies on globally integrated supply chains, and these new trade barriers create significant challenges that will be most acutely felt in the US.

The global technology industry relies heavily on complex international supply networks, for example, different nations specialise in specific components from semiconductors to batteries. Startups reliant on international supply chains may face delays and increased production costs, but supply chains will adapt over time with new trading partners, alternative solutions, and deals struck.

1. Global Supply Chain Disruptions

The tariffs disrupt global supply chains for key components like solar panels, batteries, and wind turbines. For example:

China, which produces 75% of the world's lithium-ion batteries and many rare earth minerals, has imposed retaliatory tariffs on critical materials like graphite and rare earth metals. China will likely export more clean tech to low- and middle-income countries.

Canadian and Mexican steel, essential for wind turbines and EVs, faces higher costs due to U.S. tariffs.

North American companies contribute advanced grid technologies and steel components - these costs will rise.

European manufacturers focus on wind turbines and electric vehicles, there may be a knock-on impact of price hikes.

India could benefit - the country got off relatively light compared to China and Southeast Asia and it could now have an opening to increase solar exports to the US.

2. Increased Costs

Tariffs on Chinese imports (up to 34%) and European goods (20%) could raise costs for climate tech globally, as manufacturers adjust prices to maintain profit margins.

This could make renewable energy less competitive compared to fossil fuels - but there is good news - established markets like solar and wind will remain cost-competitive despite tariffs.

3. Shifts in Global Investment

The trade war undermines investor confidence:

Increased Risk Premiums: Investors may demand higher returns to compensate for geopolitical risks, making it harder for startups to raise funding at competitive rates.

Although fossil fuel investment will become more lucrative in the US, progressive US investors may shift more focus towards European startups, while European investors may invest more heavily in local, home-grown solutions. This may foster an environment where European startups can thrive without US-investment.

4. Slower Clean Energy Transition

Higher costs and disrupted supply chains may delay renewable energy deployment globally if:

Small and medium-sized businesses are less likely to invest in clean technologies like heat pumps or solar panels due to economic uncertainty. This slowdown could hinder global efforts to reduce emissions and meet climate goals.

5. Shift in Global Competitiveness

Chinese firms may gain a competitive edge as U.S.-based companies struggle with tariffs:

Chinese electric vehicle (EV) manufacturers are poised to expand globally while U.S. automakers face higher costs for transitioning to EVs.

Europe’s Green Tech Expansion: With increased tariffs on U.S. imports, European firms may see new opportunities to build regional supply chains and strengthen domestic industries.

Emerging Markets Adapt: Countries like India and Brazil could fill supply chain gaps, especially in battery manufacturing and solar panel production.

6. Regional Variations in Impact

Climate tech in different regions will experience the effects of tariffs in unique ways:

Europe: European startups benefit from strong regional climate policies and funding initiatives.

Asia: Chinese firms dominate battery and solar panel production but face indirect impacts from tariffs targeting Vietnam, Thailand, and Cambodia.

Developing Nations: Countries relying on affordable clean tech imports may struggle with higher costs due to disrupted global supply chains, slowing their renewable energy adoption.

Reasons for Optimism: The Green Transition Pushes Forward

What are the reasons for hope amidst the chaos? It turns out, there are still many reasons for optimism.

Major players press ahead with the green transition

While the trade war seems daunting, major players around the globe are pressing ahead with the climate transition. Let’s take a look at new recent policies around the world to protect green initiatives and support climate tech developments.

Europe:

Germany has enabled investments in climate with its updated fiscal policy

The EU has updated its fiscal rules and allocated over 100 billion euros into clean manufacturing

The EU is collaborating with Canada, Mexico, and Brazil to improve their trade deals with more green trade

Asia:

The largest trade bloc, Regional Comprehensive Economic Partnership (RCEP), is in negotiations to adopt more sustainable practices

India is finalizing a 1 billion dollar subsidy to grow the solar industry

South America:

Mexican President Claudia Sheinbaum has enacted Plan Mexico, which allows for strategic investments into green tech, education, scientific studies, and improvement of domestic industrialization

Brazil has announced Nova Industria Brazil which prioritises green industrialization

These new initiatives signal sustained momentum for climate startups, even in a volatile trade environment.

Silver Linings: Opportunities for Climate Startups

Despite market instability, there are key opportunities for startups that adapt strategically.

Could this trade war become a heyday for startups that focus on driving efficiency in manufacturing and the circular economy? Reuse, recycle, and reduce will go a long way in a world where imports and global supply chains are under threat.

Local Manufacturing Gains Traction – Companies that shift production closer to home or within tariff-exempt regions can avoid increased costs.

Resilient Supply Chains – Dual sourcing, nearshoring, and alternative materials (e.g., sodium-ion batteries instead of lithium-ion) can help mitigate risks.

Increased Private Investment – While federal policies may introduce volatility, private investors may step in to support innovative climate tech startups.

Advantage for Established Technologies – Technologies like wind and solar, which have already achieved cost parity with fossil fuels, remain competitive despite tariffs.

Regional Market Expansion – Countries outside the U.S. and China, such as India and Brazil, may be presented with new growth opportunities as global supply chains shift.

Innovation in Materials & Manufacturing – Companies pioneering 3D printing, circular economy models, or alternative battery chemistries (like sodium-ion) can capitalize on the need for tariff-resistant solutions.

How Climate Tech Startups Should Respond

To navigate these shifts, climate tech founders must be agile. Here’s a strategic roadmap:

Localize & Diversify Supply Chains – Explore nearshoring opportunities and partnerships in tariff-exempt regions.

Leverage Policy Incentives – Tap into EU Green Deal funds and national subsidies wherever possible to offset cost increases.

Adopt Resilient Business Models – Shift toward circular economy models, subscription-based services, and any software-driven solutions that minimize material dependencies.

Use Data-Driven Strategies – Invest in AI-powered supply chain analytics to adjust procurement in real time.

Forge Strategic Alliances – Partner with industry groups, investors, and policymakers to influence trade decisions and access bulk-purchasing benefits.

Innovate Around Tariffed Materials – Develop alternative battery chemistries and explore non-traditional materials for manufacturing.

Expand into Emerging Markets – Identify markets less affected by U.S.-China trade tensions, such as Latin America, Southeast Asia, and Africa.

Final Thoughts

While Trump's tariffs present undeniable challenges, there is an opportunity for the agile startup that can change tack quicker than a large corporation where needed. Founders who proactively localize supply chains, leverage policy incentives, and innovate around trade barriers will not only survive but thrive. Maybe consumers and business will start to value products more - shifting away from throw-away culture and into supporting local business and the circular economy. Global supply chains may become more diverse and more resilient to future shocks.

North American startups, investors, and eco-warriors will need to support each other to make it through this tumultuous time. The country may have swung wildly from one climate direction to another - but within a couple of years time, that pendulum may well swing back the opposite direction again.

Warren Buffet always exclusively focused on the performance of companies, rather than that of stocks: in the short term, a stock price is driven by the mood and momentum of investors - in the long run, their value is derived from the value of the underlying business. He reminds us that there has never been a time in history when stock markets tumbled…and didn’t pick back up.

Climate founders - you know your true value and how well your business delivers on its promise. Continue to focus on true value, and the market will reward you in time.

Buffet’s advice for volatile times is to heed the words of Rudyard Kipling…

Rudyard Kipling 1865 –1936, If

If you can keep your head when all about you

Are losing theirs and blaming it on you;

If you can trust yourself when all men doubt you,

But make allowance for their doubting too;

If you can wait and not be tired by waiting,

Or, being lied about, don’t deal in lies,

Or, being hated, don’t give way to hating,

And yet don’t look too good, nor talk too wise;

If you can dream—and not make dreams your master;

If you can think—and not make thoughts your aim;

If you can meet with triumph and disaster

And treat those two impostors just the same;

If you can bear to hear the truth you’ve spoken

Twisted by knaves to make a trap for fools,

Or watch the things you gave your life to broken,

And stoop and build ’em up with wornout tools;

If you can make one heap of all your winnings

And risk it on one turn of pitch-and-toss,

And lose, and start again at your beginnings

And never breathe a word about your loss;

If you can force your heart and nerve and sinew

To serve your turn long after they are gone,

And so hold on when there is nothing in you

Except the Will which says to them: “Hold on”;

If you can talk with crowds and keep your virtue,

Or walk with kings—nor lose the common touch;

If neither foes nor loving friends can hurt you;

If all men count with you, but none too much;

If you can fill the unforgiving minute

With sixty seconds’ worth of distance run—

Yours is the Earth and everything that’s in it,

And—which is more—you’ll be a Man, my son!

💥 Find out how you can stand out on our Climate Marketplace to attract investor enquiries…

Just sign up on the platform and fill out the details about your fundraise to get exposure to 3,000 climate investors.

Further reading:

EU Supply Chain Regulations are Reshaping Business - Here’s What You Need to Know

Thank you for reading The Green Techpreneur.

🥂SparkTheTransition,

“You can cut all the flowers, but you cannot keep Spring from coming.”

― Pablo Neruda