Pitch Me: Investors react to Trump's election win

How will climate tech investment be affected by an anti-climate U.S. president?

Hello Green Techpreneur readers,

We have an exciting update. Climate startups can list their fundraise on our Climate Marketplace site, to reach a large network of proven climate investors.

The site has already helped raise $200 million for startups since 2020.

We’re proud to be providing startups with the fundraising visibility they need.

Climate investors, if you would like to receive an exclusive weekly newsletter that highlights high-value startups raising funds, you can register on the site.

Donald Trump's return to the White House is expected to have significant implications for climate tech investment, with far-reaching challenges and potential opportunities globally.

Trump plans to curtail federal spending on climate tech and has pledged to "terminate" spending on green initiatives, including rescinding unspent funds from the Inflation Reduction Act (IRA) and ending electric vehicle tax credits. This is undoubtedly a blow to climate tech. The prospect of less federal support is likely to create uncertainty for some investors and possibly even deter investment in less mature clean technologies.

But some venture capitalists are already thinking about stepping in to fill the void and bipartisan support exists for certain climate-friendly initiatives, such as clean energy development, next-generation geothermal energy, and decarbonising heavy industries.

Globally, the momentum behind renewable energy is strong and growing: the International Energy Agency reported that global investment in clean technology is running at double the size of coal, oil and gas in 2024. China, the E.U., the UK and Japan among others continue to step up efforts to give green initiatives wings.

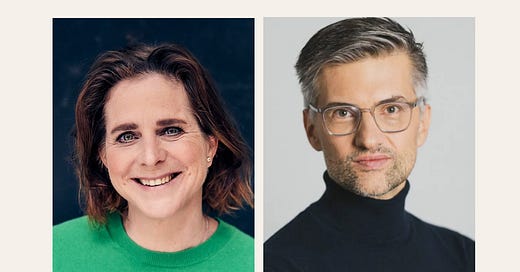

In this Green Techpreneur edition, climate tech investors Janneke Niessen, Founding Partner at CapitalT, and Danijel Visevic, Co-founder at World Fund, share their thoughts on the future of climate tech investing.

Do you think we’ll see an increase in alternative financing options, if federal support declines? How can startups best access these resources?

Janneke Niessen, Founding Partner at CapitalT

If federal support for climate tech declines, private capital—particularly venture capital and private equity—will be crucial in filling the gap. Deep tech investments have historically required a combination of public and private funding, especially in the early stages when the technology is still unproven.

Startups that prioritize scalable solutions, such as renewable energy innovations, carbon capture technologies, and resource efficiency platforms, while demonstrating both economic viability and environmental impact, will be best positioned to attract these investments.

Countries that continue to support these ventures now have the opportunity to gain a significant advantage, as fostering innovation in climate tech can drive long-term competitiveness and leadership in the global market.

Do you think corporations will play a more significant role in advancing climate tech?

The transition to net-zero is increasingly being driven by market forces, with consumer demand for sustainable products and the plummeting cost of renewable energy leading the charge.

This shift empowers corporations to take a more prominent role in advancing climate technologies, creating significant opportunities for startups to partner with them, innovate, and scale impactful solutions for a decarbonised future. Now is the time for bold action and collaboration across all sectors to accelerate this transition and secure a sustainable future for all.

What global climate tech investment trends are on the horizon?

I believe that despite potential US policy shifts, Europe is solidifying its position as a global climate tech leader.

Driven by ambitious EU targets like the European Green Deal, which aims to make Europe the first climate-neutral continent by 2050, and strong government support such as Germany’s €8 billion climate and transformation fund, European climate startups raised over €20 billion in 2023. I expect this momentum to continue, with growing investment in key sectors like carbon capture and green hydrogen.

How do you foresee a Trump presidency affecting climate tech investment?

Trump is obviously someone who does not understand the climate crisis and, even worse, is fully committed to oil and gas. However, he will only weaken the IRA where it is of no benefit to his people. Subsidies from which Tesla and Elon Musk benefit, for example, will certainly not be withdrawn. Subsidies from which Republican politicians benefit will also remain in place.

What are strategies for startups to mitigate negative impacts?

Get to revenues asap. Try to avoid being dependent on subsidies. Build products that would prevail even without positive climate policy because they are cheaper, better, more convenient and efficient, more beautiful, healthier and cleaner.

Do you think we’ll see an increase in alternative financing options, as U.S. government support declines?

Europe will step up as described in the Draghi report. As you can see in the mission letters, Ursula von der Leyen wants her commissioners to execute on Draghi's report which underscores the urgent need for Europe to transform its early leadership in industrial decarbonization and cleantech innovation into lasting competitiveness.

Editors note:

The Draghi report calls for radical change to reverse Europe’s economic decline and close the innovation gap with key competitors including the US and China. The proposal for a New Industrial Strategy for Europe is based on three pillars including closing the innovation gap, developing a joint plan for decarbonisation and competitiveness and increasing security and reducing dependencies. The report recommends a massive investment plan - an estimated €750-800 billion per year is needed to maintain competitiveness.

What are reasons to remain optimistic about the future despite the multiple global crises?

Climate tech will generate superior profits because it mostly delivers products that are cheaper, better, more convenient and efficient, more beautiful, healthier and cleaner.

That people are essentially social beings whose basic need is to be valued and loved and to love and do good to others. Only that creates real and deep happiness.

Do you have a tip for how to deal with the instability we are facing...both on a personal level, and as a business?

Knowing that there will always be ups and downs, but that the big trend means progress in many respects: https://ourworldindata.org/

The Green Techpreneur (GT) is here to #SparkTheTransition to a world where people, planet and profit align. We are a springboard platform for climate tech startups: we offer an investor/startup marketplace to help you raise funds and a magazine to share innovation and insight – by founders for founders. Join our network of over 5,200 climate tech entrepreneurs, investors, and sustainability warriors. Investors: view and contact our startups raising funds here.

Want to read more? Catch up on these interviews with climate tech innovators:

What does a Trump presidency mean for climate tech startups?

Concrete jungle, rising heat: why cities are ground zero for the climate fight

How mining giant Rio Tinto and Founders Factory selected their 2024 cohort

Thank you for reading and listening to The Green Techpreneur.

Enjoy your weekend! 🎉

✨#SparkTheTransition,